-

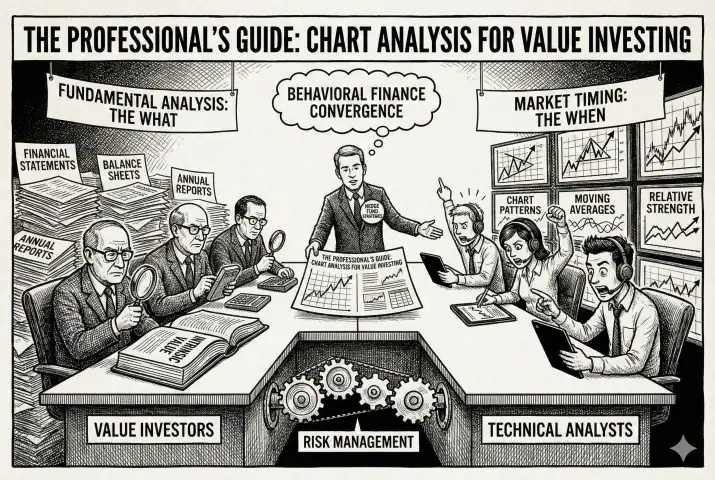

Continue reading →: Chart Analysis for Value Investing: A Professional Guide

Continue reading →: Chart Analysis for Value Investing: A Professional GuideMaster chart analysis for value investing. Learn how to time the market using technical patterns, moving averages, and event-driven strategies used by hedge funds.

-

Continue reading →: Techno-Fundamental Analysis: The Ultimate Guide to Combining Value and Charts

Continue reading →: Techno-Fundamental Analysis: The Ultimate Guide to Combining Value and ChartsMaster Techno-Fundamental Analysis by integrating fundamental valuation with technical timing. Learn strategies from market legends like Paul Tudor Jones to optimize entry points and risk management.

-

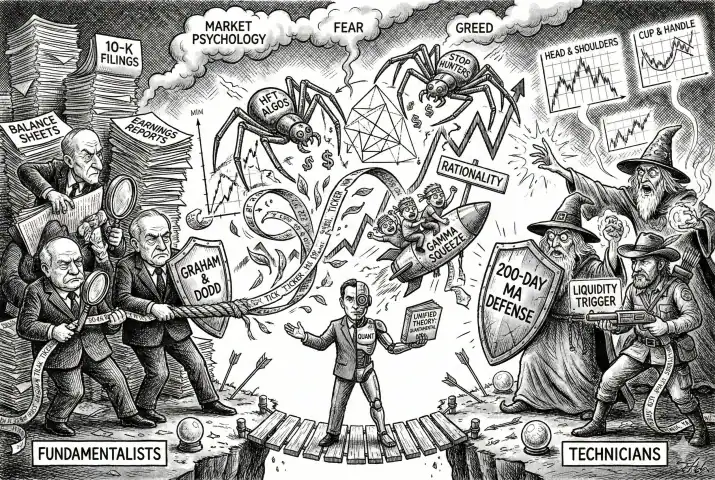

Continue reading →: Chart Analysis Strategies: Institutional Patterns & Market Psychology

Continue reading →: Chart Analysis Strategies: Institutional Patterns & Market PsychologyMaster professional chart analysis by combining hedge fund strategies, financial statements, and market psychology. Learn to interpret stock patterns and timing like a market wizard.

-

Continue reading →: Technical Analysis and Chart Patterns: A Unified Theory of Market Psychology

Continue reading →: Technical Analysis and Chart Patterns: A Unified Theory of Market PsychologyMaster technical analysis and chart patterns by combining them with fundamentals. Learn how legends like Paul Tudor Jones and Stanley Druckenmiller navigate market psychology, algorithmic trading, and earnings volatility to maximize returns.

-

Continue reading →: Export Controls vs. China’s Technological Momentum: The Kinetic Moat Analysis

Continue reading →: Export Controls vs. China’s Technological Momentum: The Kinetic Moat AnalysisCan export controls stop China? This analysis explores the “Kinetic Moat” across semiconductors, EVs, and solar, revealing why industrial scale drives technological momentum.

-

Continue reading →: Price Action Trading Guide: Institutional Reversal Dynamics

Continue reading →: Price Action Trading Guide: Institutional Reversal DynamicsMaster price action trading strategies by decoding market reversals. Learn to identify bull traps, momentum displacement, and institutional liquidity setups.

-

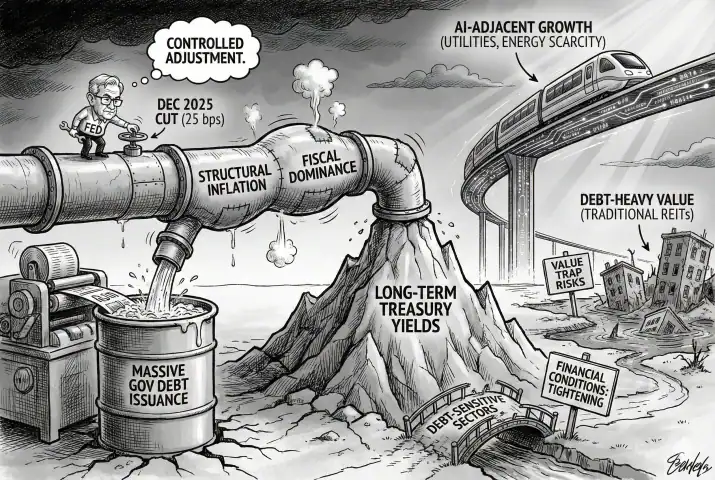

Continue reading →: 2026 Investment Strategy: AI Utilities Growth, Rate Cut Failures, and Value Traps

Continue reading →: 2026 Investment Strategy: AI Utilities Growth, Rate Cut Failures, and Value TrapsExpert analysis on the Fed’s controlled adjustment. Learn why rising 10-Year Treasury Yields are failing the rate cut narrative, driving AI Growth in Utilities, and exposing Value Traps in REITs for the 2026 Outlook.

-

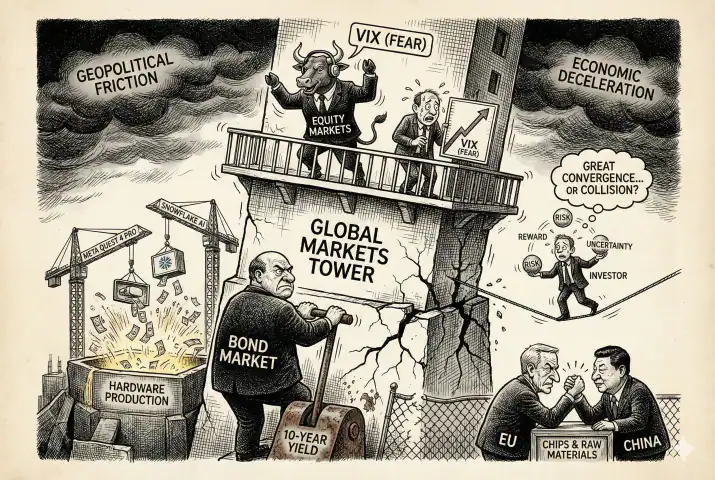

Continue reading →: Reflexivity and AI Infrastructure: Analyzing the S&P 500’s Confidence Game, Private Credit Risk, and 2025 Valuation

Continue reading →: Reflexivity and AI Infrastructure: Analyzing the S&P 500’s Confidence Game, Private Credit Risk, and 2025 ValuationAnalyze the 2025 Stock Market paradigm. Discover how Reflexivity links high S&P 500 Valuation (P/B 5.56x) to the AI Infrastructure boom, which drives 92% of U.S. GDP Growth. We detail the fragility introduced by the Private Credit debt gap and the inflationary threat posed by the Federal Reserve policy outlook.…

-

Continue reading →: Venezuela-Refiner Arbitrage: MPC Stock Analysis & Geopolitical Thesis

Continue reading →: Venezuela-Refiner Arbitrage: MPC Stock Analysis & Geopolitical ThesisInstitutional analysis of the Venezuela regime change opportunity for U.S. refiners. Discover why Marathon Petroleum (MPC) is the superior heavy sour crude arbitrage trade in a risk-off market.